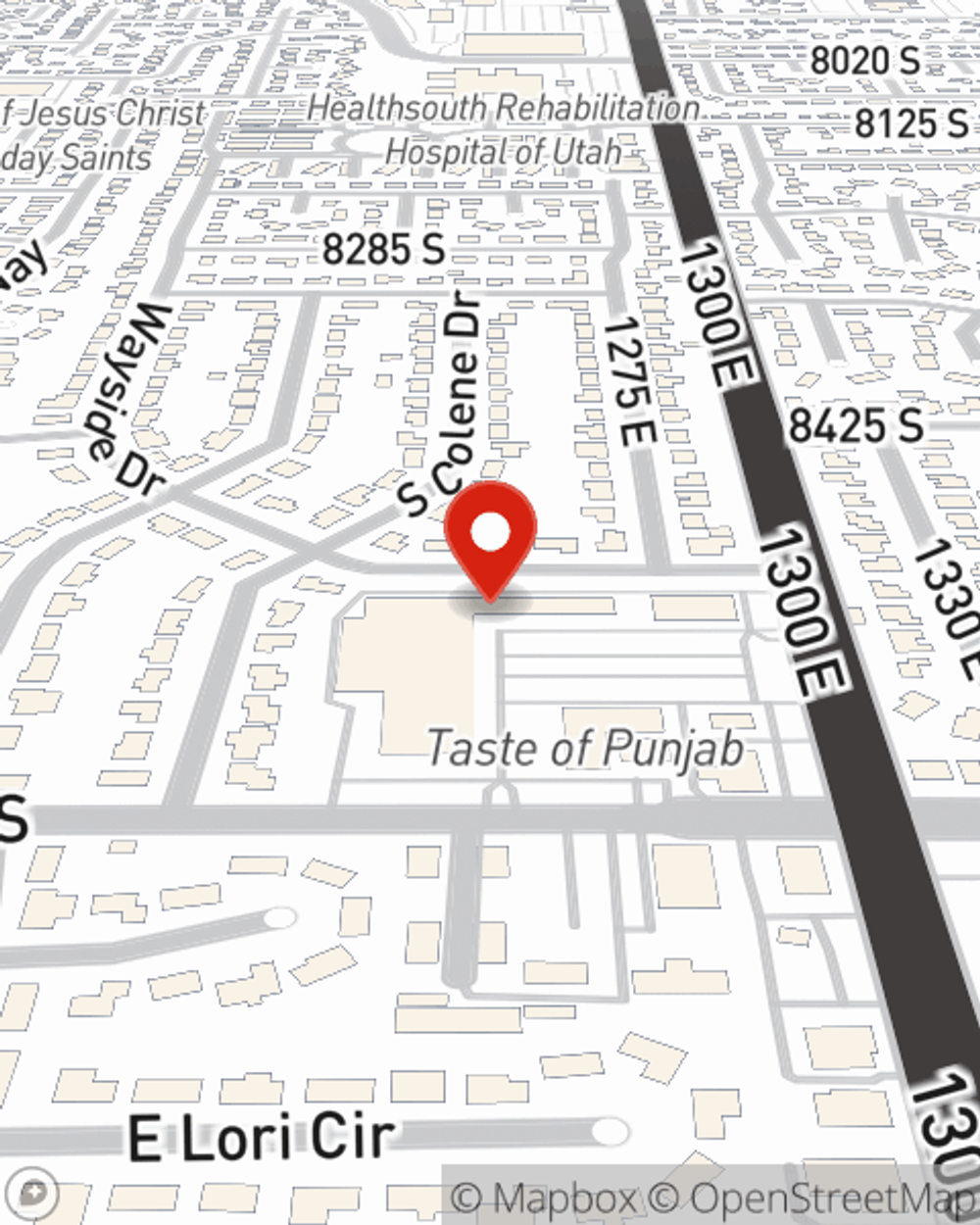

Business Insurance in and around Sandy

One of the top small business insurance companies in Sandy, and beyond.

This small business insurance is not risky

- Sandy

- Cottonwood Heights

- White City

- Draper

- Midvale

- Granite

- Riverton

- South Jordan

- West Jordan

- Bluffdale

- Herriman

- Taylorsville

- Salt Lake City

Business Insurance At A Great Value!

As a small business owner, you understand that sometimes the unpredictable is unavoidable. Unfortunately, sometimes problems like an employee getting hurt can happen on your business's property.

One of the top small business insurance companies in Sandy, and beyond.

This small business insurance is not risky

Get Down To Business With State Farm

Protecting your business from these possible catastrophes is as easy as choosing State Farm. With this small business insurance, agent Leila Sanchez Albino can not only help you personalize a policy that will fit your needs, but can also help you submit a claim should an issue like this arise.

Don’t let worries about your business stress you out! Call or email State Farm agent Leila Sanchez Albino today, and discover how you can benefit from State Farm small business insurance.

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Leila Sanchez Albino

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.